what is the difference inflation from the 1980s to today

Posted by Brent Gloy on February 29, 2016

past Brent Gloy

As the farm sector lurches through a painful economical slowdown, many are leery of another farm fiscal crunch. While a full word of the differences and similarities of these periods would require a significant amount of discussion and analysis, nosotros thought that it would exist useful to examine one key area in which the current situation differs significantly from the 1970'due south farm boom and 1980'south bust.

The Great Inflate

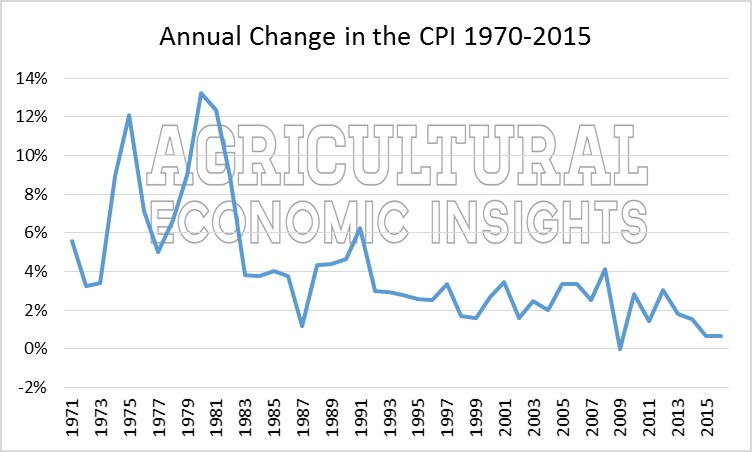

Heading into the 1980's farm crunch the general economy experienced inflation levels much higher than anything seen in recent times. Annual inflation rates peaked above 12% three times during the 1970s and 1980s (1974, 1979, & 1980). Rates were at their highest in 1979 and 1980 when double-digit rates were observed for two consecutive years (13.3% in 1979 and 12.4% in 1980) (Effigy one). These high rates had many undesirable impacts on the broader economy, but they were particularly distortionary for the farm sector.

Figure 1. U.Southward. Almanac Inflation Rates based on the Consumer Price Index (CPI) 1970-2015. Data Source U.S. Bureau of Labor Statistics, retrieved from FRED Database, Federal Reserve Banking concern of St. Louis.

Figure 1. U.Southward. Almanac Inflation Rates based on the Consumer Price Index (CPI) 1970-2015. Data Source U.S. Bureau of Labor Statistics, retrieved from FRED Database, Federal Reserve Banking concern of St. Louis.

The high rates of inflation encouraged people to search for investments that provided protection from inflation. Farmland was viewed as one such investment. As a consequence, buyers were willing to invest in farmland with the expectation of inflation driven valuation increases. These expectations were then dashed when inflation was brought under control. This search for an inflation hedge was further complicated by the fact that the high rates of inflation resulted in very depression real interest rates, making it attractive to utilise financial leverage to purchase farmland.

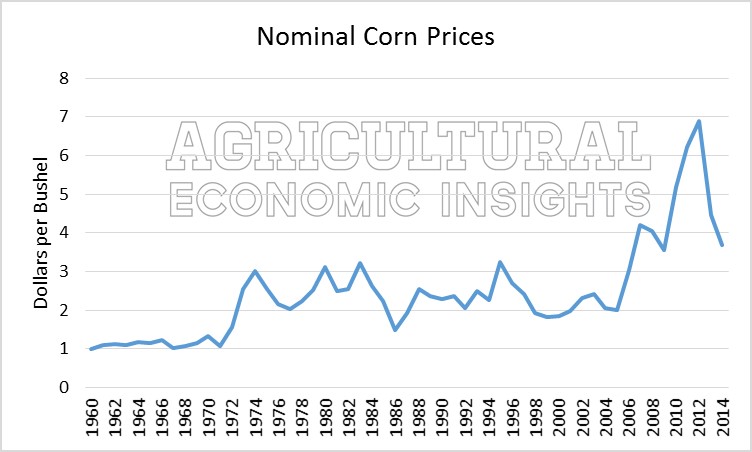

Aggrandizement too made it difficult to recognize the relative levels of commodity prices. In nominal terms, corn prices kickoff peaked in 1974 at $3.02 per bushel before falling to $2.02 in 1977 (Figure 2). However, many people are surprised to learn that in nominal terms corn prices actually rebounded to slightly over $iii per bushel twice in the early on 1980s. In 1980 corn prices hit $3.xi and in 1983 they reached $three.21 per bushel.

Figure 2. Nominal Corn Prices, 1960-2015.

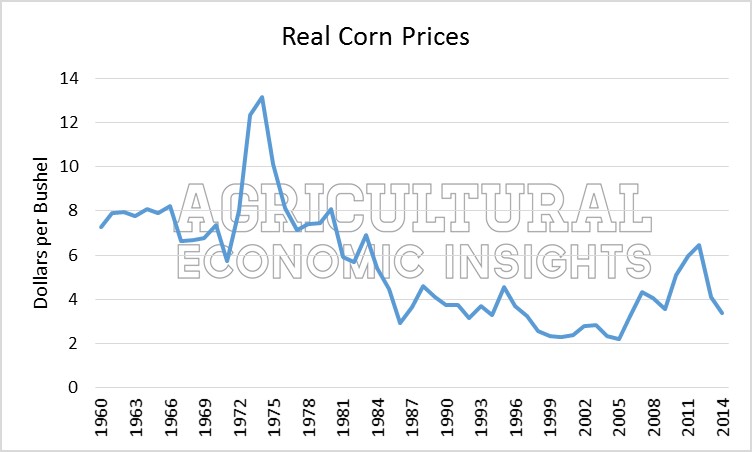

The only problem with this rebound was that in real terms this represented a significant pass up in corn prices. Every bit can be seen in Figure 3, the "rebound" in corn prices was completely wiped out by the sky high aggrandizement rates of the menstruation. In fact, using real 2009 dollars, the 1974 cost spike would equate to slightly over $13 per bushel in 2009 dollars. When adapted for inflation, the rebound price of 1980 was only over $8 per bushel for a real refuse of 38%. Afterward adjusting for aggrandizement, the 1983 price was again lower at $6.91 per bushel. In other words, inflation took a huge bite out of price levels, while nominal prices were higher.

Figure 3. Existent (2009) Corn Prices, 1960-2015.

Further compounding problems, the medicine used to cure the high inflation rates was one of loftier nominal involvement rates. The U.South. prime bank involvement charge per unit hit 20% in December of 1980 and stayed above 17% until November of 1981. For half-dozen of those 11 months the prime number charge per unit was in excess of a staggering 20%. As we discussed here, this had the affect of creating a tremendous spike in real interest rates. These loftier nominal and real interest rates set off a tremendous financial crash in the sector that had levered up in a period of depression real interest rates.

The Situation Today

Currently aggrandizement rates have been very low. They take regularly registered below iv% since the 1990. Since 2000 the inflation charge per unit has averaged 2.1% with a superlative of four.1% in 2007. More recently, aggrandizement has been below 2% since 2011.

The contrast between the 1970s and today is probably greatest when it comes to inflation. Today's rates are simply much, much lower than that experienced in the 1970s. In that location are certainly prognosticators that have worried nigh increasing rates of inflation. To this betoken inflation remains stubbornly low, and then much so that monetary policy makers have regularly been worried near too fiddling inflation every bit opposed to too much inflation. Information technology is always possible that things could change rapidly, merely at present inflation remains very low.

Although at that place are clearly similarities between the state of affairs today and the previous bust, there are also many major differences. We believe that the difference between inflation rates is i of the most important. While the lack of inflation to date does not insulate the farm economic system from a major bust, it certainly doesn't hurt.

On the other hand in some ways the ag sector is experiencing its own version of deflation, as output prices (and now input prices) fall. Our feeling is that whether this becomes a serious problem volition likely depend upon the extent to which farmers have used also much leverage.

While sector level indications suggest that the debt load is manageable, debts are not repaid at the sector level. Some farms and agribusinesses volition undoubtedly be over levered and experience financial difficulty. Whether this presents serious systematic problems will depend on how many farmers notice themselves in this state of affairs.

Wrapping information technology Up

In comparing the situation to the 1980s we think that information technology is important to think just how bad the 1980's were. They were terrible.The crisis put tremendous strains on rural communities and the institutions that financed agriculture. In this written report Stam and Dixon chronicle how the bankruptcy rate during this period exceeded even that of the Great Depression. According to a 1991 study past Hanson, Parandvash, and Ryan at the elevation of the crunch, nigh 17% of U.S. farms were financially stressed and past 1985 over 46,000 commercial farms were insolvent[1].

Unless conditions deteriorate substantially we think it unlikely that annihilation approaching that number will be realized, and that is indeed a good matter.

Interested in learning more? Follow the Agricultural Economic Insights' Blog as we track and monitors these trends throughout the years. Also, follow AEI on Twitter and Facebook.

[i] Hanson, Gregory, G.H. Parandvash, and J.Ryan. "Loan Repayment Issues of Farmers in the Mid-1980'due south." United State Department of Agronomics: Agronomical Economical Report Number 649. 1991.

Photograph by Johnny Klemme

Source: https://aei.ag/2016/02/29/inflation-one-big-difference/

0 Response to "what is the difference inflation from the 1980s to today"

Enregistrer un commentaire